Press release -

UK consumer spending showed resilience in July

Kevin Jenkins, UK & Ireland Managing Director at Visa commented:

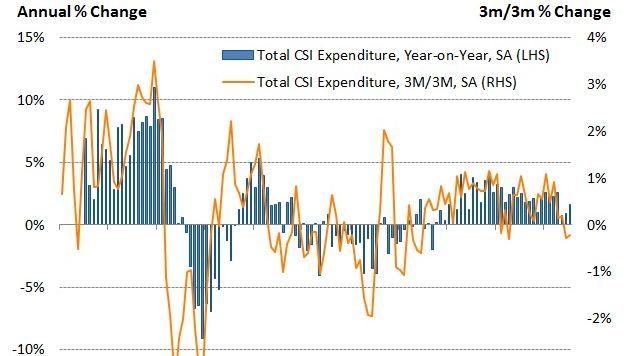

“July’s data suggests that UK consumer spending is holding up despite the ongoing uncertainty following the referendum, albeit at lower levels of growth than we’ve seen in the last couple of years. Looking at the last three months, the Index indicates that consumers remain cautious with their spending. Overall growth is hovering nearly one percentage point below the average seen over the past two years.

“Looking at the sectors, the longer term trend we’ve seen for increased spending on leisure and recreation is enduring. And the high street saw its strongest annual growth rate in five months with clothing retailers in particular bouncing back after a fall in June.”

What UK businesses are saying:

Visa is tracking the sentiment of several small businesses across the UK on a monthly basis, asking about their views on the economy, business conditions and forecasts for the month ahead.

Josh Beer, The Illustrious Pub Company, Cambridgeshire:

Overall, this was a good month for us with revenue up 6.2% compared to last month. A lot of this was due to the performance of our outdoor catering business, as we were called in to provide food for BBQs, weddings and corporate summer parties.

Sales at our pubs also benefited from the Euros and July’s heatwave. In our site where a large screen TV had been installed sales surged, and among our locations, those that allowed customers to dine al fresco were the best performers.

Gayle Haddock, Carry me home (Children’s Clothes), London

July was a quieter month for us. We don’t think that is down to the impact of the Leave vote. Instead, it was more likely because many of our customers have gone away with their families, while the mid-July heatwave also caused a drop in our online traffic, with the site receiving fewer visitors on the hottest days of the month.

We’ve also noticed a fall in our international sales. But we can’t yet say whether this is because the fluctuating currency exchanges have made overseas consumers more hesitant with making purchases in Sterling.

Tony Bailey, Top Notch Hair & Beauty, Manchester:

The warmer weather brought more people out and onto the high street, but at the same time many of our regulars have been on holiday abroad, or away on last minute staycations. This meant that we weren’t able to benefit from the payday surge that we often get towards the end of the month. But the customers coming through our doors did treat themselves well, as the initial concerns about the UK’s vote to leave the EU appears to have died down for many of them.

Categories

Visa Inc. (NYSE:V) is a global payments technology company that connects consumers, businesses,financial institutions, and governments in more than 200 countries and territories to fast, secure and reliable electronic payments.

We operate one of the world’s most advanced processing networks — VisaNet — that is capable of handling more than 65,000 transaction messages a second, with fraud protection for consumers and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees for consumers. Visa’s innovations, however, enable its financial institution customers to offer consumers more choices: pay now with debit, pay ahead with prepaid or pay later with credit products. For more information, visit our website (www.visaeurope.com), the Visa Vision blog (www.vision.visaeurope.com), and @VisaEuropeNews

Visa UK