Visa Europe is a payments technology business owned and operated by member banks and other payment service providers from 38 countries.

Visa Europe is at the heart of the payments ecosystem providing the services and infrastructure to enable millions of European consumers, businesses and governments to make electronic payments. Its members are responsible for issuing cards, signing up retailers and deciding cardholder and retailer fees. Visa Europe is also the largest transaction processor in Europe, responsible for processing more than 18 billion transactions annually.

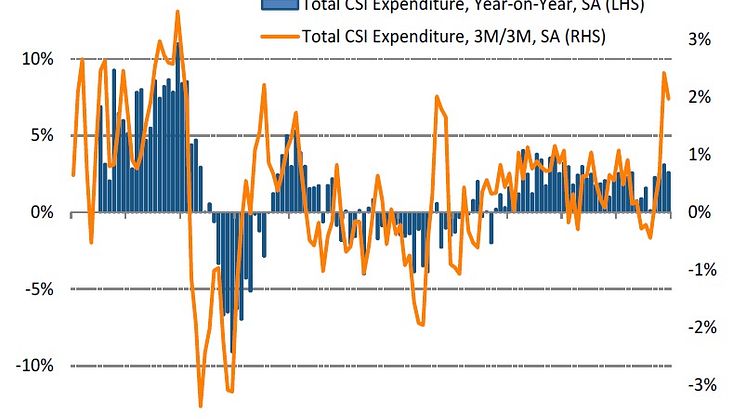

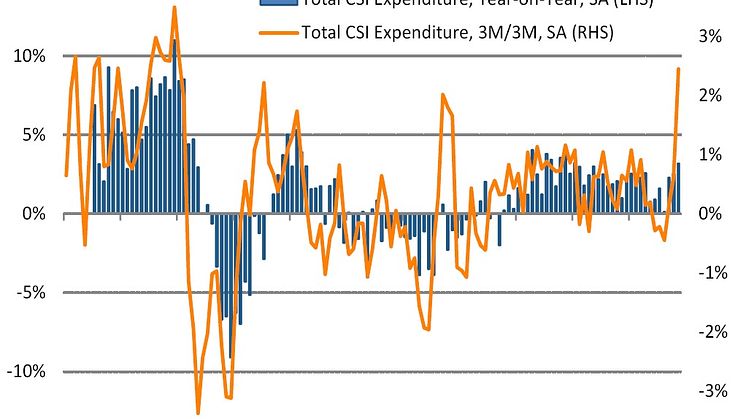

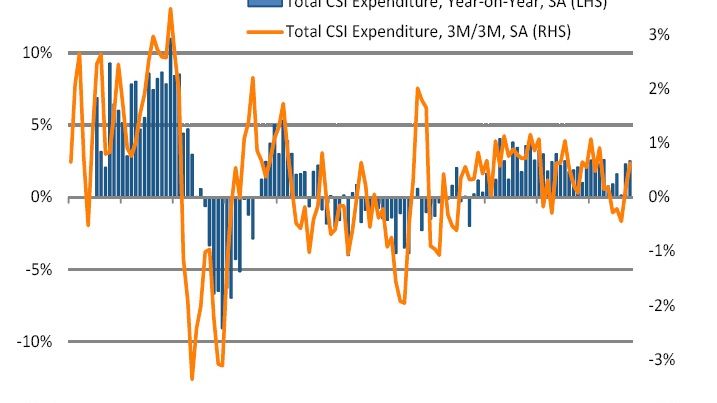

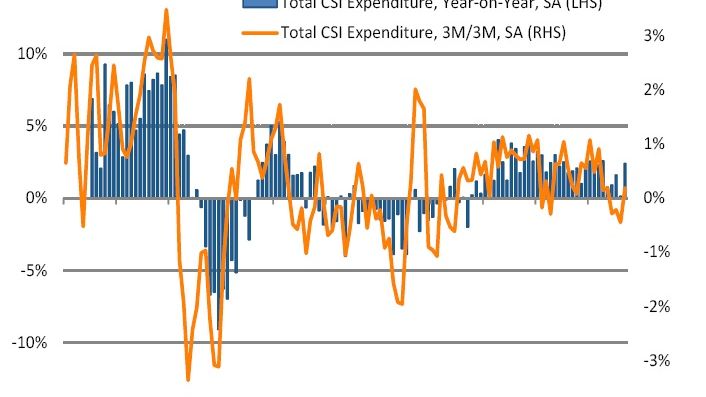

There are more than 500m Visa cards in Europe, while €1 in every €6 spent in Europe is on a Visa card. Total expenditure on Visa cards exceeds €2 trillion annually, with €1.5 trillion spent at point-of-sale.

Visa Europe is an independent business with an exclusive, irrevocable and perpetual licence to use the Visa brand in Europe. Visa Europe works in partnership with Visa Inc. to enable global Visa payments in more than 200 countries and territories.

For more information, visit www.visaeurope.com and @VisaEuropeNews