Press release -

Report on the Progress After the Release of Nidec's Letter of Intent and on Nidec's Opinion

In relation to the letter of intent (the "Letter of Intent") that was released by Nidec on December 27, 2024 in the press release titled "Notice Regarding Scheduled Commencement of Tender Offer for Makino Milling Machine Co., Ltd. (Securities Code: 6135)," we hereby report on the progress after the release of the Letter of Intent and on Nidec's current opinion regarding this matter.

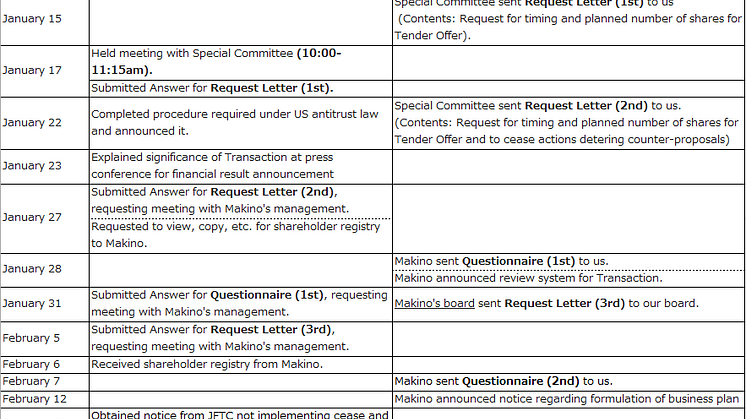

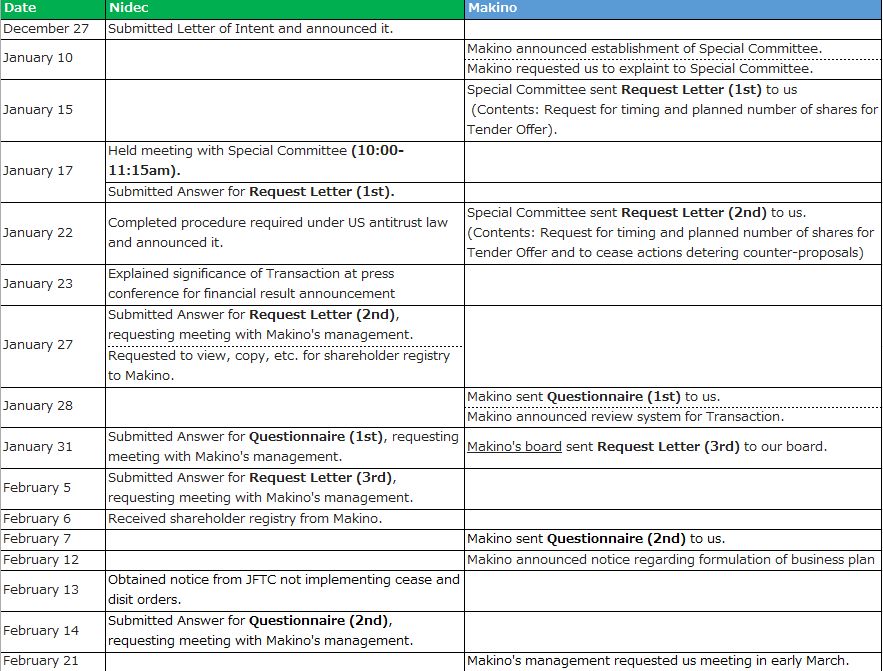

1. Progress after Release of the Letter of Intent

2. Approach which Nidec used for this case is extremely fair.

First, a series of transactions (the "Transactions") are being planned by Nidec to make Makino Milling Machine Co., Ltd. (hereinafter referred to as "Makino") into a wholly owned subsidiary of Nidec. We would like to reiterate that the approach we have chosen to propose (the "Proposal") is an extremely fair approach. Nidec has chosen the approach for the following reasons.

(1) Ensure "transparency" to stakeholders, especially shareholders, and avoid lost opportunities by providing appropriate selling opportunities to shareholders

Listed companies are obligated to disclose information in accordance with laws, regulations, and the Rules regarding the Financial Instruments and Exchange Law so that investors are provided with appropriate information to make investment decisions. However, when a takeover offer is made to a listed company prior to its public announcement, the target company is not legally obligated to announce to the public that it has received the takeover offer, and in fact, in our guess there have been cases where management or some of its employees, at their discretion, have not disclosed information about the takeover offer, resulting in depriving shareholders of an appropriate sale opportunity. In addition, the Ministry of Economy, Trade and Industry (METI) published on August 31, 2023 its "Guidelines for Corporate Takeovers - Enhancing Corporate Value and Securing Shareholders' Interests" (hereinafter referred to as the "Guidelines"). The Guidelines point out the possibility of damage to corporate value and shareholders' interests when acquisitions are made without providing the target company and its shareholders with the necessary time and information.

In addition, the Guidelines state, "In principle, upon receipt of an acquisition proposal to acquire corporate control, management or directors should promptly submit or report such matter to the board of directors." As a code of conduct for the Board of Directors, the Board of Directors is required to consider any sincere acquisition proposal seriously, disclose information that is useful for shareholders to make a decision in an appropriate and positive manner, and ensure that shareholders have a reasonable opportunity to make a decision.

In this respect, the approach used by Nidec for this case allows shareholders, who are the most important stakeholders of the target company, to know the fact that an acquisition proposal has been received from the stage of receipt of the proposal, and also makes transparent the process of how the management, to whom the shareholders have entrusted management, make decisions regarding the acquisition proposal, and how such decisions are made. This will ultimately provide shareholders with a basis for deciding whether or not an acquisition proposal and the target company's Board of Directors' decision on it are the best option for the target company's corporate value and, in turn, the common interests of its shareholders. On the other hand, if this process is not made visible, shareholders will have no way of knowing that such a sale opportunity exists, and may suffer a loss of opportunity.

The approach used by Nidec for this case ensures transparency to stakeholders other than shareholders, enabling the acquirer to recognize the reactions of each stakeholder and to consider PMI (post-merger integration process) measures that take each stakeholder's interests into consideration from an early stage, which is expected to lead to appropriate collaboration with each stakeholder at an early stage after the acquisition.

(2) Enabling the early provision of important information for shareholders to make appropriate decisions

If the terms of the acquisition are first announced at the start of the TOB, shareholders are given only the TOB period to consider (usually roughly 30 business days).

In this regard, the approach used by Nidec for this case allows shareholders to be aware of the terms and conditions proposed by the acquirer at the time of the takeover offer (in this case, as of December 27, 2024) and gives them sufficient time to consider whether such terms and conditions are in the common interests of shareholders, compared to the case where the terms of the takeover are first announced at the time the TOB is launched.

In addition, management entrusted with management by shareholders is required by the Guidelines that "at the time an acquiring party commences to acquire corporate control, informed judgment by shareholders will be possible through substantial information disclosure by the target company and through providing important decision-making materials that contribute to the judgment on the appropriateness of the transaction terms." As stated in the above, based on such code of conduct, the management is required to provide information necessary for shareholders to decide whether they should tender their shares in the TOB or whether they should continue to hold their shares. The approach used by Nidec for this case will enable the target company to provide such information at an early stage, and even if the target company expresses its opinion in favor or against the TOB immediately before the end of the consideration period, it will be possible for the acquirer, the target company's management (and the special committee) to discuss how to proceed at an early stage during the ample time available for the consideration. This is expected to make the process of discussions more transparent.

(3) Proposals without prior consultation have not been labeled as hostile

If a takeover offer is publicly announced after such an offer is rejected, as in the case of a takeover offer made behind the scenes and rejected, it may appear as if the takeover offer were a hostile takeover offer vis-à-vis general shareholders and other stakeholders who would become aware of the existence of the takeover offer only after the announcement of the offer.

Our case is, so to speak, an open love letter, and we are not making the Proposal on the assumption that it will be hostile to the management of Makino. While it is up to the management and shareholders of Makino to decide how to accept or reject the Proposal, our approach taken for this case is intended to allow us to discuss measures that will contribute to improving the corporate value of Makino in an amicable manner together based on their accurate understanding of the contents of the Letter of Intent.

(4) Provide an opportunity to reevaluate whether current management policies are leading to increasing corporate value

The approach used by Nidec for this case gives general shareholders an opportunity to objectively look at the target company's current management policy and management situation, and to reexamine whether it will lead to an increase in corporate value in the future. This could also contribute to the target company's management policy being brushed up (improved) as a result of this opportunity. In particular, the presentation of a specific acquisition price will enable a quantitative comparison with the current management policy and market share price based on such policy, and will provide the best opportunity for general shareholders to check the management policy, management strategy, and management results of the current management team.

(5) To have the effect of reducing waste in the M&A process, revitalizing the capital market, and speeding up industrial restructuring

In reality, it often takes a long time from the time an acquisition proposal is made behind the scenes to the time it comes to the negotiating stage, and we assume that some target companies may not be able to make a decision immediately. This approach will avoid unnecessary time from passing, and will also encourage early and serious consideration of go or not go. As speedy corporate actions, such as management decisions, are required to win in international competition, we believe that this approach will contribute to speeding up industrial restructuring.

3. Which is the better to accept our TOB offer or to continue to hold Makino shares?

We would like all current shareholders to tender their shares in the tender offer proposed by Nidec (the "TOB"). In making such decision, we would like to express our opinion as to which is the better for you to continue to hold Makino shares or to tender your shares in the TOB.

In conclusion, we believe that tendering your Makino shares to the TOB is the better option, rather than continuing to hold the shares. We would like to explain the reasons for such opinion below.

(1) Uncertainty about the possibility of achieving Makino's revised business plan

In deciding whether it is better to continue to hold shares of Makino, the first and most important question is how to evaluate Makino's future performance. In this regard, the item entitled "Toward Enhancing Corporate Value" in the "Notice of Business Plan" released by Makino on February 13, 2025 (hereinafter referred to as the "Revised Business Plan"), is very informative. This Revised Business Plan is very informative as it explains in more detail than the previous business plan, but we believe that the effectiveness of each strategy cannot be assured.

(2) Achievement of the Revised Business Plan is not always reflected in the target stock price

The evaluation of Makino's corporate value based on the Revised Business Plan depends largely on the certainty of the feasibility of achieving the Revised Business Plan.

Furthermore, even if the Revised Business Plan is achieved, this will not necessarily be reflected directly into an increase in the stock price.

It is difficult to forecast stock prices because corporate performance is affected by external factors such as the future economic environment and global conditions. In addition, the evaluation of the Revised Business Plan may differ from one shareholder to another, as well as from investors who are considering to invest in the future.

In this regard, Makino's stock price was down 0.3% on February 13, the next day, and down 0.8% one week later on February 19, compared to the closing price on February 12, the day immediately prior to the announcement of the Revised Business Plan. This indicates that there are at least some investors who have doubts about the feasibility and certainty of the Revised Business Plan at this stage.

(3) Effectiveness of Shareholder Returns

Since the shareholder return plan outlined in the Revised Business Plan is contingent on the achievement of the Revised Business Plan, failure to achieve the plan will mean less resources for the shareholder return plan. In addition, if Makino tries to implement the shareholder return plan earlier (at an earlier timing), the amount of cash that would have been allocated to capital investment and R&D will decrease, limiting investment for corporate growth, i.e., while the amount of the shareholder return plan targeted is increasing, the average annual capital investment is decreasing in the plan.

(4) Conclusion.

(1) Given the details explained in (1) to (3), in order to achieve a return to shareholders (share price increase and shareholder return (dividends)) that exceeds the price proposed by Nidec ("Nidec's Proposed Price"), Makino must certainly achieve the following hurdles.

①Makino's Revised Business Plan must be implemented and achieved.

②After achieving the Revised Business Plan, it should be recognized in the stock market and lead to an increase in the stock price, or be reflected in the market stock price as soon as possible (because if the progress is not satisfactory, it will not lead to an increase in the stock price).

③Excessive shareholder return plan do not lead to growth because shareholder return plan is contingent on achieving the business plan.

As stated above, even if Makino continues to operate its business independently, there are many uncertainties in achieving an increase in the stock price above Nidec's Proposed Price, so we believe that the best option is to return Nidec's Proposed Price to shareholders in cash.

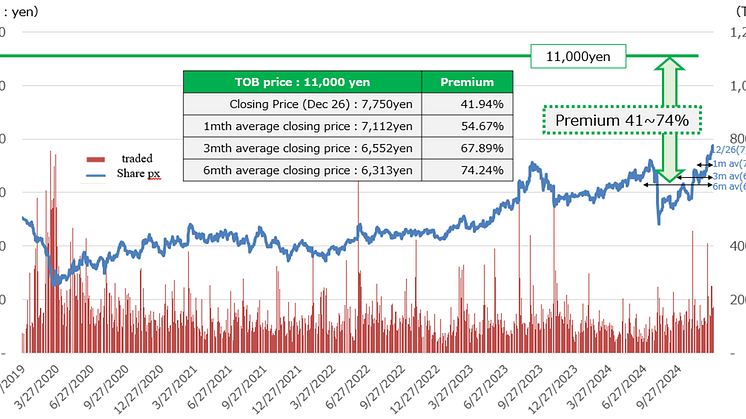

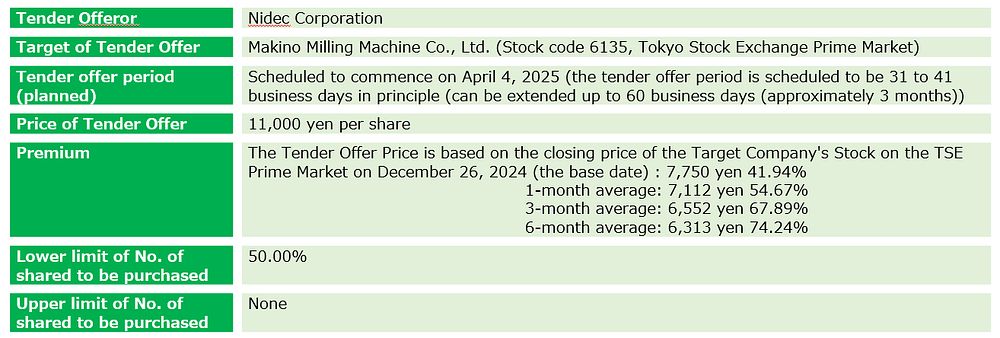

4. Nidec's Proposed Price

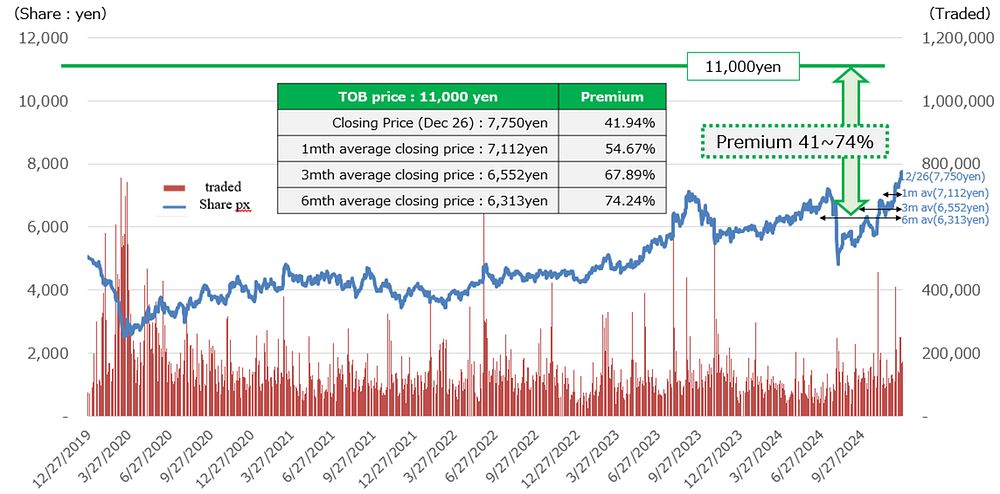

Nidec's Proposed Price is 11,000 yen per share, and Nidec intends to purchase the shares at such price from all shareholders of Makino. This price is the price at which no capital loss will be incurred by all shareholders of Makino over the past 20 years from December 27, 2024, the date of the public announcement of the submission of the Letter of Intent.

We believe that Nidec's Proposed Price of 11,000 yen is a necessary and sufficient level, and at this stage we have no plan to raise the TOB price from this price, even if any shareholder requests a price increase or if a competing proposal by a white knight or others offers a price higher than the proposed price.

Summary of Letter of Intent

5.Status of Antitrust Clearance

As disclosed in Nidec's press release, Nidec obtained clearance under the Antitrust Acts on January 22, 2025 in the U.S. and on February 13, 2025 in Japan. Nidec has been successful in obtaining clearance under the Antitrust Acts. In Japan's Antitrust Act procedures, in cases that have a significant impact on competition, JFTC notifies the notifying company and conducts procedures to hear the opinions of customers and competitors. In this case, JFTC did not notify Nidec of any such notification, and the review process was completed earlier than the statutory prohibition period. At the very least, the fact that JFTC did not judge that any restriction of competition would arise as a result of this Transaction and that there is no possibility of events occurring that would be disadvantageous to customers is considered evidence that JFTC has judged that there is no possibility of such events occurring. In other words, the products of the two companies have basically proven to be complementary, and it is easy to imagine that there is minimal overlap and minimal cannibalization (Note) of the two companies' products.

(Note) "Cannibalization" refers to the phenomenon in which two companies' products with similar value to customers compete with each other for sales.

Again, as stated above, there is a high degree of uncertainty regarding the continued holding of Makino stock, and the Proposal offers a premium that is sufficient in light of Makino's past stock price performance, and we believe that the best option for Makino's shareholders is to tender their shares in this TOB. Therefore, we would appreciate it if you would reconsider the Proposal.

| [Restrictions on solicitation] This press release is intended to announce the Tender Offer to the public and has not been prepared for the purpose of soliciting an offer to sell shares. If shareholders wish to make an offer to sell their shares, they should first read the Tender Offer Explanation Statement concerning the Tender Offer and make an offer to sell their shares at their own discretion. This press release shall neither be, nor constitute a part of, an offer to sell or purchase, or solicitation to sell or purchase, any securities, and neither this press release (or a part of this press release) nor its distribution shall be interpreted to constitute the basis of any agreement in relation to the Tender Offer, and this press release may not be relied upon at the time of entering into any such agreement. [Future Forecasts] This press release may contain forward-looking statements, including those related to the future business of Nidec Corporation (the “Tender Offeror” or the “Offeror”) and other companies, such as “anticipate,” “expect,” “intend,” “plan,” “believe,” and “assume.” Such statements are based on the Tender Offeror's current business prospects and may change as a result of future developments. The Tender Offeror is under no obligation to update any forward-looking statements in this information to reflect actual business performance or changes in various circumstances or conditions. This press release contains "forward-looking statements" as defined in Section 27A of the U.S. Securities Act of 1933 (as amended) and Section 21E of the Securities Exchange Act. The actual results may be grossly different from the projections implied or expressly stated as “forward-looking statements” due to known or unknown risks, uncertainties or other factors. None of the Offeror or its affiliates assures that such express or implied projections set forth herein as "forward-looking statements" will eventually prove to be correct. "Forward-looking statements" contained herein were prepared based on the information available to the Tender Offeror as of the date of this press release and, unless required by laws and regulations, neither Tender Offeror nor its related parties including related companies shall have the obligation to update or correct the statements made herein in order to reflect the future events or circumstances. [U.S. Regulations] The Tender Offer shall be implemented in compliance with the procedures and information disclosure standards provided by the Financial Instruments and Exchange Act of Japan, which procedures and standards are not necessarily identical to the procedures and information disclosure standards applied in the United States. Specifically, Section 13(e) or Section 14(d) of the U.S. Securities Exchange Act of 1934 (as amended; “Securities Exchange Act”) or the rules promulgated under such Sections do not apply to the Tender Offer, and the Tender Offer is not necessarily in compliance with the procedures and standards thereunder. It is not necessarily the case that all financial information in this press release is equivalent to financial statements of companies in the United States. It may be difficult to enforce any right or claim arising under U.S. federal securities laws because the Offeror and Makino Milling Machine Co., Ltd. (“the Target”) are incorporated outside the United States and their directors are non-U.S. residents. Shareholders may not be able to sue a company outside the United States and its directors in a non-U.S. court for violations of the U.S. securities laws. Furthermore, there is no guarantee that shareholders will be able to compel a company outside the United States or its subsidiaries and affiliates to subject themselves to the jurisdiction of a U.S. court. The financial advisors of the Offeror or Target and their respective affiliates may, within their ordinary course of business, purchase, or conduct any act toward the purchase of, the shares of the common stock of the Target for their own account or for their customers’ accounts outside the Tender Offer prior to the commencement of, or during, the period of the Tender Offer, etc. in accordance with the requirements of Rule 14e-5(b) under the Securities Exchange Act to the extent permissible under the financial instruments and exchange laws and other applicable laws and regulations in Japan. If any information concerning such purchase is disclosed in Japan, the disclosure of such information will be made in the United States in a similar manner. All the procedures in connection with the Tender Offer shall be taken in the Japanese language. While a part or all of the documents in connection with the Tender Offer may be prepared in English, the Japanese documents shall prevail in case of any discrepancies between Japanese documents and corresponding English documents. [Other Countries] Some countries or regions may impose restrictions on the announcement, issue or distribution of this press release. In such cases, please take note of such restrictions and comply with them. In countries or regions where the implementation of the Tender Offer is illegal, even upon receiving this press release, such receipt shall not constitute a solicitation of an offer to sell or an offer to buy shares relating to the Tender Offer and shall be deemed a distribution of materials for informative purposes only. |

Topics

Categories

Nidec is the world's leading comprehensive motor manufacturer, specializing in "everything that spins and moves," with a strong focus on the motor business. Nidec's extensive product lineup, which ranges from small precision motors to ultra-large motors, leverages the technological capabilities of its approximately 340 group companies across 46 countries. These products are used in various fields, including IT equipment, automobiles, motorcycles, commerce, and industry. We remain dedicated to providing the world with indispensable products and solutions at an overwhelming speed, utilizing technologies aimed at lightness, thinness, shortness, compactness, and efficiency.