Press release -

Record high for cash withdrawals at Post Offices

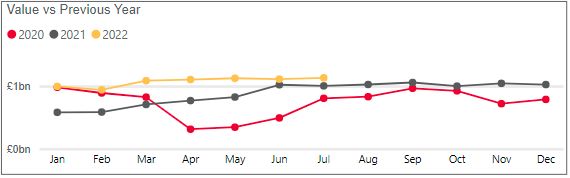

- Post Offices handled a record £801 million in personal cash withdrawals in July, up almost 8% month-on-month (£744 million, June 2022)

- Post Office attributes increase to more Brits taking staycations in the UK and people increasingly relying on cash to manage their budget

- Only second time that personal cash withdrawals have exceeded £800 million (previous time was December 2021 when there’s always an increase in withdrawals)

- In total, a record £3.32 billion in cash deposits and withdrawals were handled at Post Office’s 11,500 branches. First time amount has exceeded £3.3 billion in a single month

- Personal cash deposits totalled £1.35 billion, up 2% month-on-month and business cash deposits totalled £1.13 billion, up 1.9% month-on-month

New figures today reveal Post Offices handled a record £801 million in personal cash withdrawals. In total, over £3.3 billion in cash was deposited and withdrawn over Post Office counters, the first time figures have crossed the £3.3 billion threshold in Post Office’s 360-year history.

Personal cash withdrawals were up almost 8% month-on-month (£744 million, June 2022) and up over 20% year-on-year (£665 million, July 2022).

Post Office has attributed the record amount for personal cash withdrawals at its 11,500 branches to more Brits choosing to have staycations in the UK as well as people increasingly turning to cash to manage their budget on a week-by-week basis and often on a day-by-day basis.

Post Office research last month found that 71% of Brits planning on going on holiday in the UK this year plan to take out cash before leaving to go on holiday. Of those who have been on holiday in the UK in the last five years, almost a third (31%) admitted to being caught out cashless whilst on holiday in the UK.

In July, Post Office also processed over 600,000 cash payouts for people eligible to receive energy bill support from the UK Government. This totalled around £90 million and provide people with an opportunity to pay energy bills, top up gas and electricity meters or use the cash to budget.

Personal cash deposits totalled £1.35 billion in July, up 2% month-on-month (£1.33 billion, June 2022). Business cash deposits totalled £1.13 billion in July, up 1.9% month-on-month (£1.11 billion, June 2022).

In total, a record £3.31 billion in cash deposits and withdrawals were handled at Post Office in July, £100 million higher than in June, £3.21 billion.

Martin Kearsley, Banking Director at Post Office, said:

“Our latest figures clearly show that Britain is anything but a cashless society. We’re seeing more and more people increasingly reliant on cash as the tried and tested way to manage a budget. Whether that’s for a staycation in the UK or if it’s to help prepare for financial pressures expected in the autumn, cash access in every community is critical. Postmasters handling over £3.3 billion in a single month demonstrates just how vital being able to deposit and withdraw cash, securely and conveniently, is for millions of people.”

Post Office Cash tracker data – July 2022

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for July 2022 | |

UK[1] | £2.49bn | +1.9% | +14.1% | £828.7m | +7.6% | +20.0% | £3.32bn |

England | £2.06bn | +2.5% | +15.0% | £646.2m | +8.0% | +19.6% | £2.70bn |

Scotland | £176.8m | -0.9% | +7.9% | £60.0m | +4.7% | +12.8% | £236.8m |

Wales | £127.0m | +2.9% | +11.6% | £67.0m | +8.4% | +17.5% | £194.0m |

Northern Ireland | £123.3m | -4.0% | +10.7% | £55.4m | +5.5% | +38.9% | £178.7m |

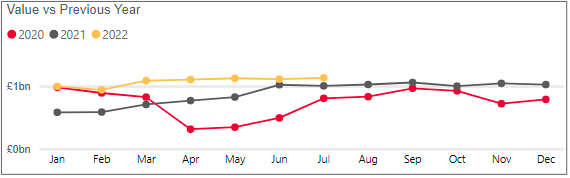

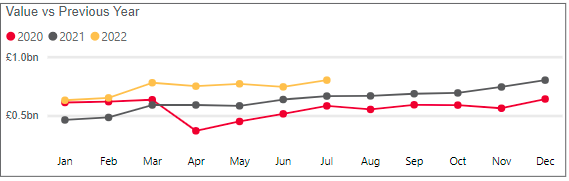

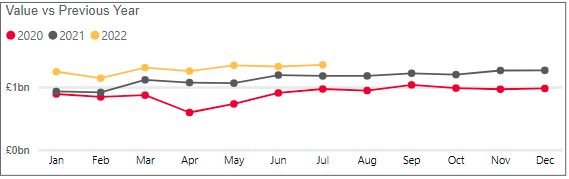

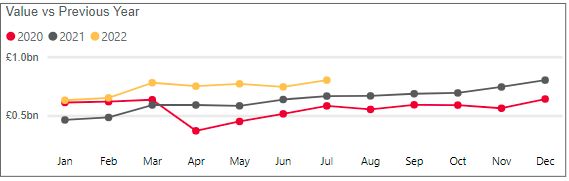

Business cash deposits

Personal cash deposits

Personal cash withdrawals

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.