Press release -

Cash deposits up almost 50% at Post Offices compared to last year when country was in lockdown

- Business and personal cash deposits totalled £2.24 billion in January, up 48% compared with a year ago (£1.51 billion, January 2021) when the country was in lockdown.

- Business cash deposits were up over 70% compared with last year highlighting the effects lockdown restrictions had on small businesses ability to trade and deposit takings

- Figures indicate potential consumer nervousness about the cost of living. Whilst cash use is always lower in January, business cash deposits dipped below £1 billion for the first time since May 2021 Personal cash withdrawals were up over a third compared with a year ago, but were down compared with recent months

- Today’s figures coincide with the exclusive distribution of the new 50p coin, marking Her Majesty The Queen’s Platinum Jubilee, via the Post Office network

Cash deposits at Post Offices were up almost 50% in January compared with a year ago. The figures come as a new agreement between the UK’s banks and the Post Office was announced last week enabling people to continue to deposit and withdraw cash at Post Office counters until December 2025.

Business and personal cash deposits totalled £2.24 billion in January compared £1.51 billion a year ago. Business cash deposits were up over 70% compared with last year but this January (£995 million) was the first-time business cash deposits had dipped below £1 billion since June 2021. Personal cash deposits were steady compared with December (£1.24 billion in January compared with £1.27 billion in December).

In total, cash deposits and withdrawals amounted to £2.9 billion in January. This was £1 billion more than January 2021 when the UK was in lockdown (£1.9 billion, January 2021). Figures highlight a recovery in the use of cash and continued economic recovery from lockdown last year.

Personal cash withdrawals were up over 36% year on year with £630 million withdrawn over the counter at Post Offices in January (£462 million, January 2021). Post Offices always see the highest amount of personal cash withdrawals in December for Christmas and this contributed to a 20% month-on-month drop in cash withdrawals in January. As in previous years, Post Office expects withdrawals to increase in the run-up to Spring.

Martin Kearsley, Banking Director at Post Office, said:

“Our figures show the significant recovery cash use has made since the country was in a full lockdown a year ago. The vast majority of businesses have been able to trade uninterrupted in January and rely on their Post Office which is open long hours to deposit their cash takings. Cash withdrawals are always lower in January and we’re closely monitoring whether the focus on the cost of living could see consumers reduce the amount of cash they’re spending. People who are budgeting can always withdraw the amount of cash they need to the penny at our branches thanks to our agreement with 30 UK banks and building society brands. Post Offices play a vital role in supporting consumers with cash and this is emphasised by our announcement last week that the agreement has been extended for a further three years.”

Today’s publication coincides with the exclusive distribution of the new 50p coin, marking Her Majesty The Queen’s Platinum Jubilee, via the Post Office network.

1.3 million coins will be issued via Post Offices across the UK from today (Monday 7 February), following the 70th anniversary of Her Majesty’s accession to the throne. The collaboration between the Royal Mint and the Post Office ensures that members of the public will get the chance to receive the special 50p coin in their change at branches nationwide.

Post Office Cash tracker data – January 2022

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for January 2022 | |

UK[1] | £2.24bn | -2.3% | +48.0% | £652.1m | -21.2% | +35.7% | £2.89bn |

England | £1.85bn | -1.2% | +50.0% | £506.5m | -20.8% | +35.2% | £2.35bn |

Scotland | £161.3m | -6.3% | +43.2% | £47.6m | -25.2% | +24.4% | £208.9m |

Wales | £111.9m | -6.4% | +42.2% | £53.5m | -21.1% | +30.3% | £165.3m |

Northern Ireland | £120.7m | -8.2% | +32.6% | £44.5m | -21.8% | +66.8% | £165.1m |

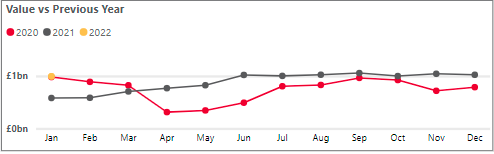

Business cash deposits

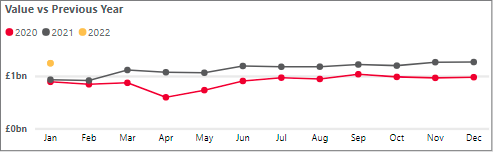

Personal cash deposits

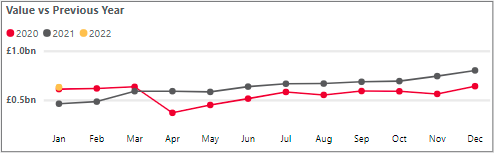

Personal cash withdrawals

For further data and analysis, visit www.corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.