Press release -

Tax Facts training for Welsh teachers launched

For the first time, HM Revenue and Customs (HMRC) has joined with a university to enable trainee teachers to deliver a programme on the facts of tax to local school children.

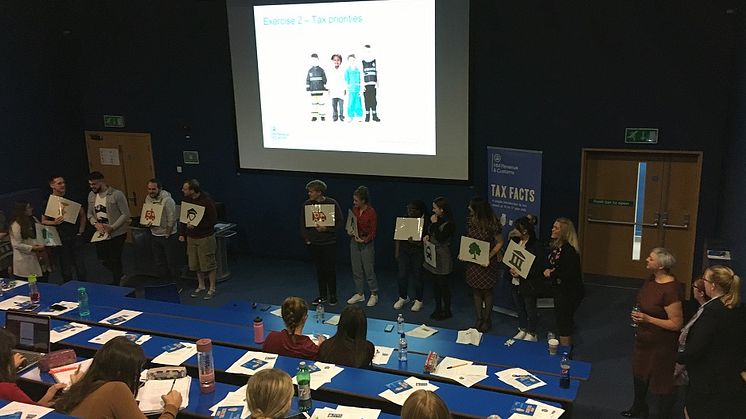

More than 200 trainee teachers, studying at the University of South Wales (USW), will be trained to teach ‘Junior Tax Facts’ to primary school children in English and Welsh-medium schools. This award-winning tax education programme for young people was developed by HMRC and is available for schools to use, free of charge.

HMRC will deliver the awareness sessions to the trainee teachers based at USW’s Newport Campus, over the next academic year.

‘Junior Tax Facts’ offers a very simple introduction to tax for 8 to 11 year-olds. The programme consists of an engaging animation and lesson plans, to help young children understand where the money comes from that pays for all the things that are essential to them, their families and communities – like local transport, the police, doctors and their school.

It also gives children the opportunity to practice important skills that they’ll need in later life, including communication and listening, literacy and numeracy, and negotiating and debating.

The ‘Junior Tax Facts’ programme will be available shortly in Welsh. ‘Tax Facts’, which is HMRC’s tax education programme for 11 to 14 year-olds, will be available in Welsh in Spring 2018.

Maureen Pamplin, Head of Sustainability at HMRC, said:

“We are excited about this new initiative and keen that it will be replicated in other universities across the country. We worked closely with teachers to develop this material and the University of South Wales is now leading the way in helping teachers to take it into the classroom, so that children understand what tax is, how the money is used and the link with vital public services.

“When they move into secondary school, our ‘Tax Facts’ programme for the older age group, helps to prepare young people for the financial realities of life, so they understand how tax works and know what to expect when they start earning.”

Jordan Allers, USW lecturer in Primary Studies, said:

“Making sure our undergraduates appreciate the important role teachers play in giving youngsters an understanding of the world beyond the classroom is a vital part of what we do here at USW.

“Working with the HMRC specialists on this project means that we are able to deliver even more real-life experience to our students and we are delighted that we have been involved in the development of this exciting project.”

Notes for editors:

1. The first presentation of ‘Junior Tax Facts’ to trainee teachers will be delivered at the University of South Wales, Newport Campus, on Tuesday 31 October from 2.15pm to 4.00pm.

2. Photographs available from the press office below.

3. ‘Junior Tax Facts’ was launched in October 2016. It provides a simple introduction to tax for 8 to 11 year-olds, by explaining that taxes provide the money needed to pay for the things that are essential to them, their families, communities and society as a whole.

4. ‘Tax Facts’ for 14 to 17 year-olds includes four short animations and a comprehensive teachers’ pack, designed to provide an introduction to the tax system for secondary school students studying Citizenship, business enterprise, personal finance and others aspects of the curriculum, that help prepare them for life beyond school.

5. The Tax Facts and Junior Tax Facts animations are available on HMRC’s YouTube channel (http://bit.ly/1MpfJiM) and on DVD. The teachers’ resources are published on the Times Educational Supplement (TES) website https://www.tes.com/teaching-resource/tax-facts-teachers-pack-11075252and https://www.tes.com/teaching-resource/junior-tax-facts-teachers-pack-11410987

All the material is available for schools and charities to use, free of charge.

6. In developing this material, HMRC sought views from representatives of the Institute of Chartered Accountants in England and Wales (ICAEW), Chartered Institute of Taxation (CIOT), the Low Incomes Tax Reform Group (LITRG), policy experts, education experts, teachers and students.

7. 'Tax Facts’ and ‘Junior Tax Facts’ have been accredited with the Personal Finance Education Group (PFEG) and Association for Citizenship Teachers (ACT) Quality Marks.

8. The programme won the 2017 Institute for Continuous Improvement in Public Services (ICiPS) Education Award. ‘Tax Facts’ was also named the ‘Best Free Educational Resource’ in the 2016 Education Resources Awards.

9. Schools can contact HMRC for further information via email: hmrc.taxeducation@hmrc.gsi.gov.uk

10. Follow HMRC’s press office on Twitter: @HMRCpressoffice

11. HMRC’s Flickr channel:www.flickr.com/hmrcgovuk

Topics

Regions

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.