Warning to Self Assessment customers as scam referrals exceed 200,000

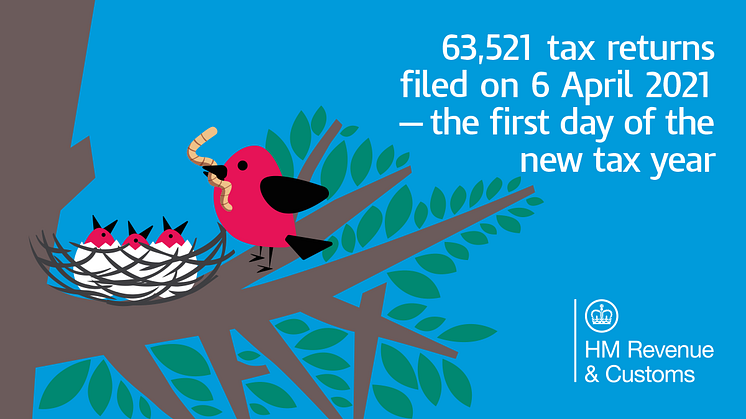

With the Self Assessment tax deadline behind us, HM Revenue and Customs (HMRC) is warning people to be wary of bogus tax refund offers. Fraudsters could set their sights on Self Assessment customers, with more than 11.5 million submitting a tax return by last month’s deadline. Taxpayers who completed their tax return for the 2022 to 2023 tax year by the 31 January deadline might be taken in.