Press release -

Spoil your loved one, with HMRC’s Valentine’s Day cash boost

HM Revenue and Customs (HMRC) is proposing to married couples and those in civil partnerships to sign up to a £250 tax break this Valentine’s Day.

More than 1.78 million couples are already committed to the Marriage Allowance boost, but it is estimated more than 2 million are missing out on up to £250 this year. If their claim is backdated, they could even receive up to £1,150. This is the last chance for eligible couples to backdate their claim for the 2015/16 tax year as the deadline for doing so is 5 April 2020.

Angela MacDonald, HMRC’s Director General for Customer Services, said:

“Applying for Marriage Allowance is a quick and easy way for married couples and people in a civil partnership to have £250 or more put back in their pockets.

“It’s fantastic to see so many couples have already put a few minutes aside to apply and we hope many more will sign up this Valentine’s Day to take advantage of this tax relief.”

Marriage Allowance lets people with income of £12,500 or less, transfer up to £1,250 of their Personal Allowance to their husband, wife or civil partner – if their income is higher. This reduces their tax by up to £250 for the 2020/21 tax year. Claims can also be backdated four years to April 2015. After 5 April 2020, couples will only be able to claim back to the 2016/17 year.

Customers are urged to cut out the middle man and receive a guaranteed 100% of their eligible entitlement, if they apply directly through HMRC.

Dan De Arriba, 34, a HR advisor from Sheffield is one of those already signed up. He said: “My wife Jie fell pregnant while she was finishing her PhD, so she did not receive any maternity leave payment. I came across Marriage Allowance on GOV.UK. It helped us financially by transferring some of the tax-free allowance from Jie to me while she was looking after our son and I was working. It helped us by saving over £200 a year at a time when it was really needed and the process of applying was very easy. I strongly recommend it to anyone in a marriage or civil partnership.”

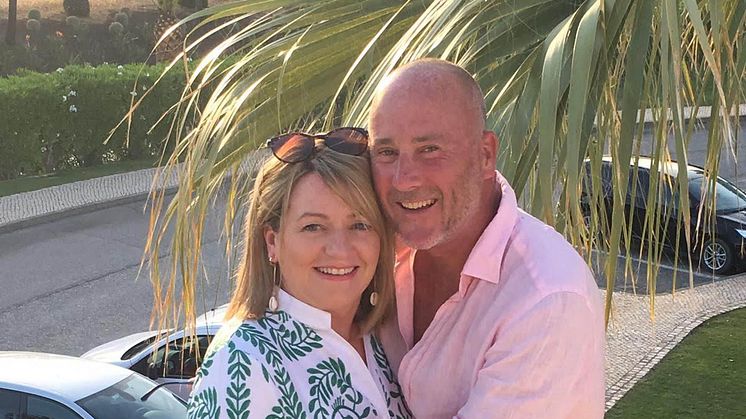

Former Manchester City Council worker Jackie Flanagan, 57, is also receiving Marriage Allowance after applying online with her husband of 35 years, Terry. She added: “It only took two minutes and the money was deposited into my bank account. It was so easy!”

Customers in England, Wales and Northern Ireland can benefit from Marriage Allowance if all the following apply:

- You’re married or in a civil partnership.

- You do not pay income tax or your income is below your Personal Allowance (usually £12,500).

- Your partner pays income tax at the basic rate between £12,501 and £50,000.

For customers in Scotland the same criteria applies, except your partner must pay income tax at the starter, basic or intermediate rates between £12,501 and £43,430.

More than four million married couples and 15,000 civil partnerships could benefit from Marriage Allowance.

Couples can find out more information and apply for Marriage Allowance at gov.uk/marriage-allowance.

Marriage Allowance claims do not need to be submitted every year because they are automatically renewed. However, couples should notify HMRC if their circumstances change.

Notes to Editors

- 1.Follow HMRC’s Press Office on Twitter @HMRCpressoffice

- 2.HMRC’s Flickr channel can be found at flickr.com/hmrcgovuk

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.