Press release -

On your marks – 100 days to file Self Assessment

- People have 100 days until 31 January deadline to file their Self Assessment tax return and pay tax owed

- Self Assessment customers urged to prepare and file their tax return early

The countdown clock has begun as HM Revenue and Customs (HMRC) reminds customers they have 100 days to file and pay their Self Assessment tax return before the 31 January deadline.

Anyone who is yet to start, can access information and guidance on GOV.UK to help them complete their tax return.

More than 3.5 million have already beaten the clock and submitted their returns. HMRC is reminding others that starting their Self Assessment early means they are more likely to complete an accurate tax return, avoid any last-minute panic plus they will know what they owe sooner and can budget.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“The countdown to the Self Assessment deadline has begun but there is still time to thoroughly prepare and file an accurate tax return by 31 January. You can access online help and support to help you file. Search ‘help with Self Assessment’ on GOV.UK to find out more.”

More than 12 million people need to file a tax return for the 2023 to 2024 tax year and pay any tax owed by the 31 January 2025 deadline.

HMRC has produced a series of YouTube videos to help people complete their return and a step-by-step guide to check what customers need to do to file their first tax return.

Customers who are unsure if they need to file a tax return can visit GOV.UK to check if they need to send a Self Assessment tax return.

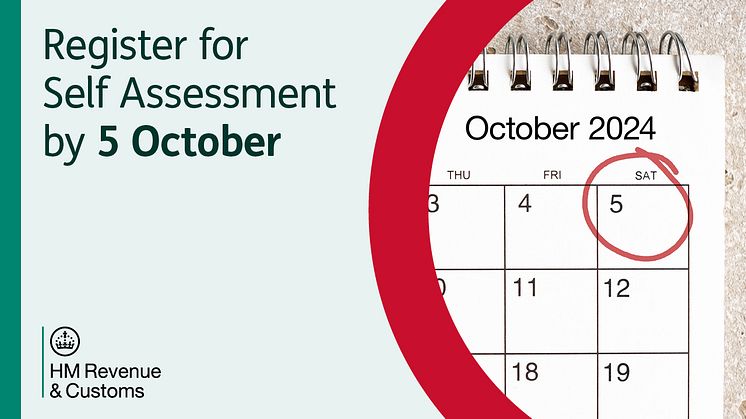

Anyone who is new to Self Assessment needs to register to receive their Unique Taxpayer Reference before they can send a tax return for the 2023 to 2024 tax year.

People who no longer need to file a tax return should tell HMRC as soon as possible to avoid any penalties. HMRC has produced 2 videos explaining how customers can go online and stop Self Assessment if they are self-employed and those who are not self-employed.

HMRC recommends that anyone who regularly sell goods or provides a service through an online platform to find out more about selling online and paying taxes. The information on GOV.UK will help them decide if their activity should be treated as a trade and if they need to complete a Self Assessment tax return.

Criminals use emails, phone calls and texts to try to steal information and money from taxpayers. Before sharing their personal or financial details, people should search ‘HMRC tax scams’ on GOV.UK to access a checklist to help them decide if the contact they have received is a scam

People should never share their HMRC login information with anyone. Someone could use them to steal from them or claim benefits or a refund in their name.

Notes to Editors

- More information on Self Assessment

- The deadlines for tax returns for 2023 to 2024 tax year are 31 October 2024 for paper returns and 31 January 2025 for online returns.

- More than 97% of Self Assessment returns are filed online.

- People can use the HMRC app to find out how to register for Self Assessment, check their Unique Taxpayer Reference, get their National Insurance number and employment income and history and pay their tax bill.

- Follow HMRC’s Press Office on X @HMRCpressoffice

Related links

- Help online for Self Assessment

- YouTube: Your online Self Assessment tax return

- This guidance will provide you with information to help you file your self assessment tax return

- Check if you need to send a Self Assessment tax return

- Check how to register for Self Assessment

- Stop being self-employed

- How to go online and stop Self Assessment if you're self-employed

- How to go online and stop Self Assessment if you're not self-employed

- Selling online and paying taxes - information sheet

- Identify tax scam phone calls, emails and text messages

- Self Assessment tax returns