Press release -

New marker launched to tackle fuel fraud

The UK and Ireland governments are to bring in a new product to mark rebated fuels, including the off-road diesel commonly known in the UK as ‘red diesel’, in a move that will boost both countries’ fight against illegal fuel laundering.

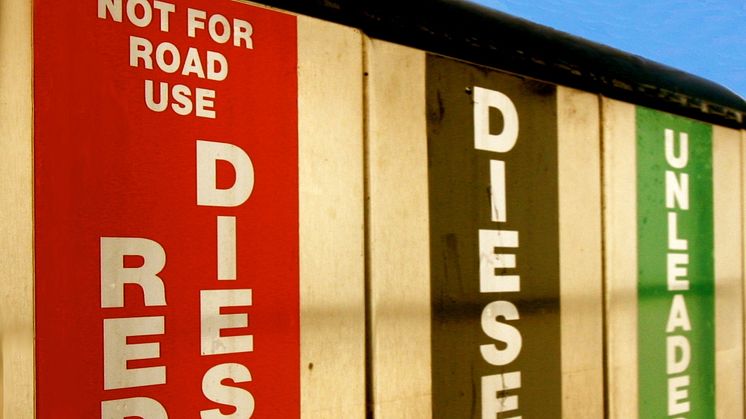

The marker will help HM Revenue and Customs (HMRC) and the Irish Revenue Commissioners tackle the criminal market in off-road diesel, marked with a red dye in the UK and green in Ireland, and also kerosene primarily used for heating oil. Excise duty on rebated diesel is charged at a lower rate than standard fuel duty.

The new marker will make rebated fuel much harder for fraudsters to ‘launder’ (i.e. remove the marker from it) and sell on at a profit.

The use of illicit diesel is estimated to be 12-13 per cent of the market share in Northern Ireland and about two per cent in the rest of the UK.

Rebated fuel use is strictly limited to specific circumstances, primarily in agriculture, construction and heating.

Nicky Morgan, Economic Secretary to the Treasury, said:

“I am delighted that our two countries have come together to fight the shared problem of illicit fuel. At a time when the government’s priority is cutting the deficit, it is unacceptable that criminals are cheating the system. The government has invested nearly £1 billion in HMRC to tackle avoidance, evasion and fraud.

“Using illicit fuel is not a victimless crime; it robs the government of tax revenue that is used to fund vital public services and puts those businesses that follow the rules at a commercial disadvantage. It also has a severe environmental impact, with considerable clean-up costs for local councils. So we are boosting HMRC’s fight against this fraud by introducing a more robust marker to ensure it is far harder to remove.”

Notes for Editors

1. The marker will be produced by The Dow Chemical Company.

2. Launderers primarily target red or green diesel, filtering it through chemicals or acids to remove the government marker. The chemicals and acids remain in the fuel and damage fuel pumps in diesel cars.

3. Although red diesel is predominantly targeted, launderers may also seek to remove the marker from other rebated fuels – especially kerosene primarily used for heating oil.

4. For UK red diesel, excise duty is charged at 11.14 pence per litre instead of the full rate of 57.95ppl. Excise duty on kerosene, used for heating, (which will also have the marker added to it) has a zero duty rate. Rebated fuel is marked with dye and chemical markers so that its use for any other purpose or illegal sale can be identified.

5. During a rigorous joint UK/Ireland evaluation, the chosen marker proved significantly more effective than the current markers on the basis of laboratory testing. This testing found that it was highly resistant to known laundering techniques.

6. The new marker will be implemented in consultation with the oil industry and other affected sectors and will be used alongside the current marker mix.

7. HMRC fights fuel fraud on a wide range of fronts, from specialist units performing thousands of roadside checks to raiding laundering plants. This new marker will be a vital tool in the continuing fight against fuel fraud and organised crime.

8. Follow HMRC on Twitter @HMRCgovuk

9. HMRC’s flickr channel - www.flickr.com/hmrcgovuk

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.