Press release -

HMRC closes in on tax cheats

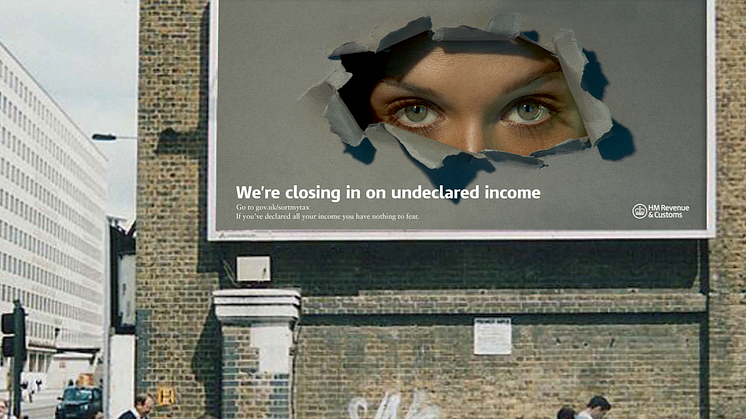

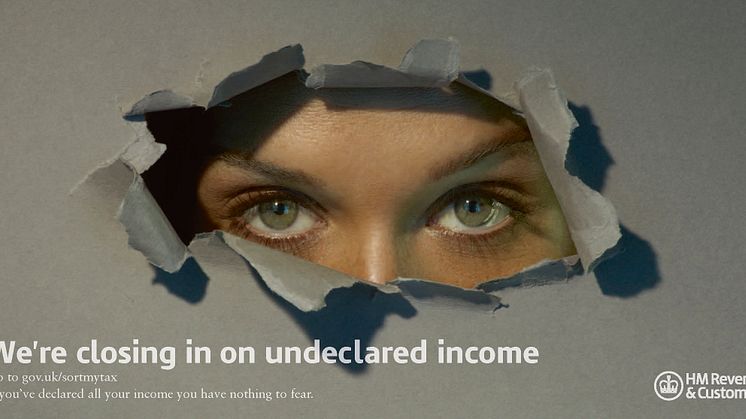

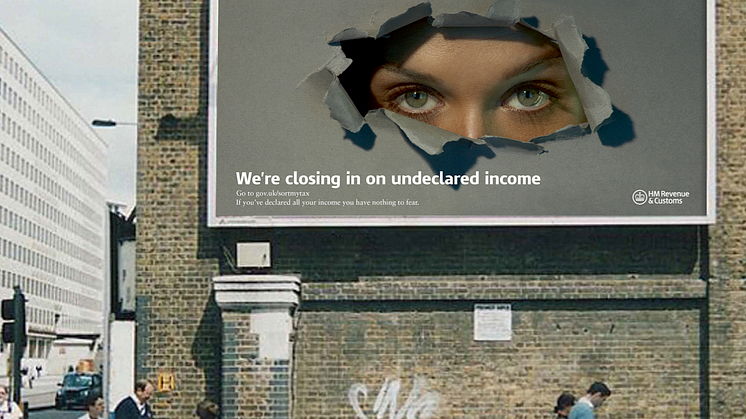

An advertising campaign warning tax cheats to declare all their income before it is too late was launched today by HM Revenue & Customs (HMRC).

The campaign is part of HMRC’s targeted approach to help taxpayers pay the right amount of tax at the right time.

HMRC has set up a website - www.gov.uk/sortmytax - to help support those who want to pay the correct tax.

The campaign, using outdoor advertising, is part of HMRC’s activity to tackle crime and failure to pay the right amount of tax.

David Gauke, Exchequer Secretary to the Treasury, said:

“Most people play by the rules and pay what they owe, but HMRC is cracking down on those who don’t. Using the £917 million the Government has made available to tackle avoidance, evasion and fraud, HMRC is closing in on tax cheats.

“It always makes sense to declare all your income and tax dodgers are simply storing up trouble for the future; getting caught means higher fines, and in the most serious cases criminal prosecution. There is an alternative. Simply visit the new website and make a fresh start.”

Jennie Granger, HMRC’s new Director General, Enforcement and Compliance, said:

“Most people pay the right tax. Our campaign is aimed at those who don't.

“Our message to the small percentage who don't is a simple one: ‘The net is closing in. We will detect you if you haven’t put a job through the books, if you haven’t declared investment income, if you’ve hidden assets offshore or if you haven’t even registered for VAT'.

“For these people my message is: ‘please don’t fool yourself that HMRC won’t do anything – it is only a matter of time before we catch up with you.’

”If you’ve declared all your income you’ve nothing to fear. And if you know someone who isn’t paying what they should, get in touch with HMRC. It isn’t fair that you pay what you should and they don’t.

“This campaign is one part of HMRC’s broader work to tackle evasion and fraud which includes taskforces, campaigns and offshore penalties.”

The campaign is a part of the Government’s £917 million spending review investment to tackle tax evasion, avoidance and fraud from 2011/12, which aims to raise an additional £7 billion each year by 2014/15.

If you are aware of someone who is evading their taxes you can tell HMRC via the Tax Evasion Hotline by phone, on 0800 788 887, by email or by post. Full details can be found here

Notes for editors

1. The campaign will run for two weeks from 12 November and will involve billboards, bus shelters and phone boxes.

2. HMRC worked with PhD as the planning agency and M&C Saatchi as the creative agency.

3. Follow HMRC on Twitter @HMRCgovuk

4. Images are available on HMRC’s flickr site www.flickr.com/hmrcgovuk

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.