Press release -

Do one thing – get on the HMRC app

- Talk Money Week is an annual awareness initiative – the theme this year is “Do One Thing”

- 1.7 million customers use the HM Revenue and Customs (HMRC) app every month, with 29 million sessions launched between July and September 2024 and 711,000 new users in the same period

- HMRC has today launched a new advertising campaign promoting the app, aimed at 18-34-year-olds

This Talk Money Week (4 – 8 November), taxpayers are being urged to “Do One Thing” and get on the HMRC app to save time and simplify managing their money and tax.

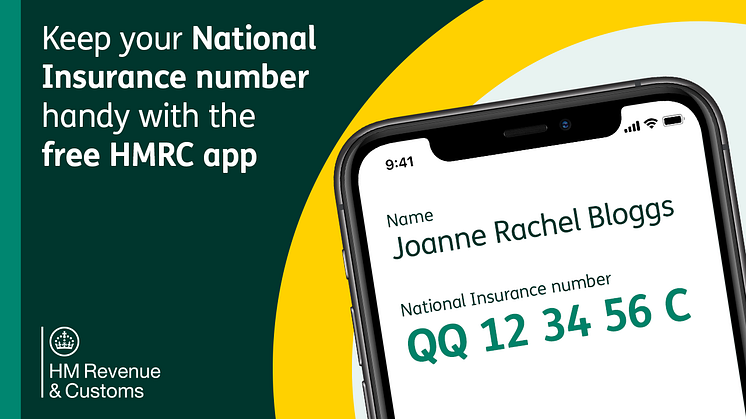

More than 1.7 million people are already using the HMRC app every month, which enables users to access services such as making a Child Benefit claim, finding your National Insurance number and a tax calculator to estimate your take-home pay.

Between July and September 2024, 711,382 new users downloaded the app, and there was a 39% increase in app activity compared to the same period last year – up from 20.93 million sessions to 29.22 million. And nearly £300 million has been paid to HMRC via the app so far this financial year.

HMRC is encouraging anyone who hasn’t yet downloaded the free and secure HMRC app, one of the UK’s top-rated finance apps, to do one thing and get on it today.

The most popular features used on the app between July and September this year were:

- Check State Pension contributions– 1.9 million sessions

- Manage Child Benefit – 1.6 million sessions

- View annual tax summaries – 1.4 million sessions

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“One of the main priorities for HMRC is improving our customer services and this incredibly useful and user-friendly app is a great example of how tax can be made much easier for people.

“Whether you’re a student looking for your National Insurance number or a new parent wanting to claim Child Benefit, the HMRC app has a range of tools for you, at your fingertips. I urge everyone to download it today.”

The HMRC app is rated 4.7/5 and 4.8/5 respectively on the Google Play and Apple Store and ranks among both of their top 10 finance apps.

HMRC has launched a new advertising campaign today aimed at 18-34-year-olds to “get on it” with the app, showcasing how it can help them remain in control of their tax affairs and finances amidst their busy daily lives. This includes an attention-grabbing new advert streaming on multiple video on demand channels that can also be viewed on the HMRC YouTube channel.

Notes to Editors

- Download the app from Google Play or Apple Store

- The HMRC app is bilingual and available in Welsh.

- You can use the HMRC app to:

- Check your tax code, National Insurance number, and income and employment history from the past five years

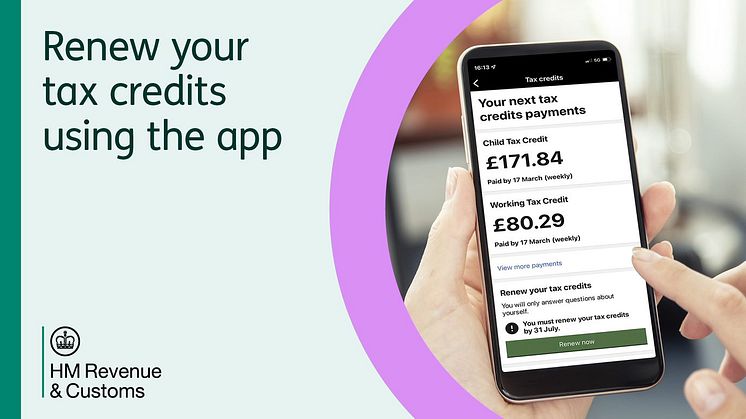

- View and manage Child Benefit, Tax Credits, and your State Pension forecast

- Access tax details, including your Unique Taxpayer Reference and income information

- Use tools like the tax calculator to estimate take-home pay, and check for National Insurance contribution gaps

- Make payments for Self Assessment, Simple Assessment, and even set payment reminders

- Access your Help to Save account and claim refunds if you’ve overpaid tax

- Track forms and correspondence with HMRC

- Update personal information like your name and address

- Save your National Insurance number to a digital wallet and opt for electronic communications from HMRC

- Use HMRC’s digital assistant for guidance and support

- Follow HMRC’s Press Office on X @HMRCpressoffice

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.