Press release -

80% of Singapore financial institutions concerned about losing revenue to innovators, finds PwC

| Date | 6 April 2017 |

| Contact | Natalie Choo Tel: +65 6236 4309 Mobile: +65 9738 1415 E-mail: natalie.yl.choo@sg.pwc.com Candy Li Tel: +65 6236 7429 Mobile: +65 8613 8820 E-mail: candy.yt.li@sg.pwc.com |

| Follow/ retweet | @PwC_Singapore |

- 80% of financial institutions in Singapore and 88% globally are concerned that their business will lose revenue to standalone FinTech companies

- More than 4 in 5 (89%) respondents surveyed in Singapore and 82% globally plan to increase FinTech partnerships in the next 3-5 years

- 82% of Singapore respondents and 72% globally plan to focus their investments on data and analytics over the next 12 months, citing it as the most relevant technology for their business currently

- 45% of Singapore respondents see FinTech as an opportunity to differentiate their business, higher than the global average of 29%

Singapore, 6 April 2017 – A large majority (82%) of global banks, insurers and investment managers intend to increase their partnerships with FinTech companies over the next three to five years. Singapore respondents indicated a similar sentiment with almost 9 out of 10 respondents (89%) planning to increase FinTech partnerships, according to a new PwC report Redrawing the lines: FinTech’s growing influence on Financial Services.

Antony Eldridge, FinTech and Financial Services Leader, PwC Singapore comments:

“In Singapore, we have seen established financial institutions investing in innovation for some time now. What is unique in Singapore is the regulator’s progressive approach which is helping to nurture FinTech growth by providing a conducive ecosystem. The introduction of regulatory sandboxes is a prime example of how the regulators here are creating an environment where new technologies can be experimented while minimising risks to consumers.

“The results indicate that there is real room for growth in Singapore’s FinTech ecosystem, which comes at a good time as we are also noticing a growing acceptance of non-traditional FinTech solutions by consumers. That, in turn, is driving FinTech solutions to grow beyond low value, high volume to address more advanced and complex needs of client groups such as in asset and wealth management.

Turning threat into opportunity

The report, drawing on a survey of over 1,300 respondents globally, shows clear signs that the international finance industry is getting to grips with innovation. One driving factor behind these partnerships is an increasing fear within the industry that revenue is at risk to standalone FinTechs, with 88% of financial services respondents globally seeing it as a real threat (83% globally in 2016).

Singapore is heading in the same direction with 80% of respondents from financial institutions seeing FinTech as a threat (73% in Singapore in 2016). As a result, a mutual understanding is emerging between the two parties - partnerships between the two can facilitate more effective innovation than either alone. On one hand, FinTech companies can benefit from financial institutions’ existing processes and infrastructure which would otherwise be too costly for them to undertake on their own. On the other hand, incumbents can leverage the innovation and new technologies from FinTech players to overcome legacy issues, sharpen operational efficiency and respond to customer demands for more innovative services.

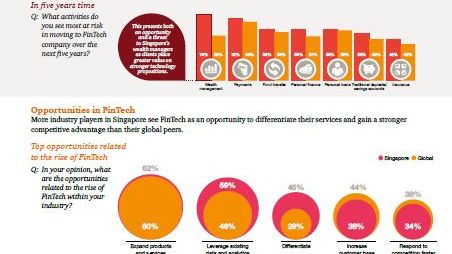

Of the opportunities related to the rise of FinTech, expanding products and services emerged as the number one opportunity in Singapore (60%) and globally (62%). Meanwhile, when it comes to leveraging FinTech to differentiate their business, more local industry players recognise this as an opportunity compared to their global peers (45% Singapore, 29% globally).

Data and analytics underpin the adoption and innovation of more advanced technologies

In Singapore, the most relevant technologies indicated by respondents are data analytics (82% Singapore, 72% globally) followed by artificial intelligence (44% Singapore, 34% globally). As data and analytics are fundamental to the adoption and innovation of more advanced technologies (e.g. artificial intelligence, mobile and cybersecurity), it is unsurprising that it emerged as the top technology that industry players will be focusing their investments on in the next 12 months.

While only 13% of Singapore respondents (20% globally) plan to invest in distributed ledger technologies (e.g. blockchain) over the next 12 months,the take-upof these technologies is expected to increase, taking into consideration that 40% of Singapore respondents have plans to implement blockchain in the next two years. The report also noticed a clear shift of industry players in the city-state becoming more familiar with blockchain technology. A year ago, 55% of respondents in Singapore said that they are “slightly” or are “not familiar” with blockchain; this year’s report shows that the figure has dropped to 32%. In addition, over a quarter (27%) say that they are now “extremely” or “very” familiar with the technology.

The global report further observes that traditional financial institutions are focusing on integrating their legacy systems with data analytics and mobile technologies in order to provide a new digital experience for customers while enhancing system security, agility and cost efficiency at the same time. Once these systems are able to keep pace with the more agile systems of FinTech companies, financial institutions will be able to invest in the technological advances that FinTech companies are already beginning to focus on – such as artificial intelligence and distributed ledger technology.

Antony Eldridge, FinTech and Financial Services Leader, PwC Singapore concludes:

“The innovators of today may not necessarily be the innovators of tomorrow. The question that companies need to ask themselves is ‘Are we innovating effectively?’ One of the preferred ways companies catalyse innovation is through partnerships and collaborations between mainstream financial institutions and FinTech companies. Companies need to be mindful that in order to reap the benefits of these partnerships, the strategic agendas and business objectives of both parties need to be aligned and clear lines of communications need to be established.”

Ends

Notes to editor

1.PwC’s 2017 Global FinTech Survey is based on the responses of 1,308 participants, principally CEOs, Heads of Departments, Heads of Innovation, Heads of IT/ Digital/ Technology from 71 countries spread across six regions and a variety of industries including banking, asset management, fund payments, insurance, reinsurance and FinTech. The majority of respondents are from large companies, but small and medium sized companies also took part in the survey. In Singapore, there were 40 respondents from a variety of industries including banking, asset management, fund payments, insurance, reinsurance and FinTech amongst others.

2.The survey also includes insights and proprietary data from PwC’s DeNovo platform. DeNovo provides on-demand consulting about FinTech and emerging technology. The platform can be used to search for analysis on specific startup companies, emerging technologies and industries. It allows you to assess the impact of innovation on your business and follow the topics, trends and companies that interest you. To try DeNovo for free, or upgrade to DeNovo Premium for deeper strategic analysis and direct access to subject matter experts, please visit https://denovo.pwc.com.

Related links

Topics

Categories

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 157 countries with more than 223,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2017 PwC. All rights reserved