Pressmeddelande -

Continued strong interest in commercial properties in the Nordic region - more net buyers than net sellers, but considerable geographic differences

Stockholm, 12 March 2018 – Cushman & Wakefield’s Nordic Investor Confidence Index for Q1, 2018 will be released simultaneously today in Helsinki, Copenhagen, Oslo, Stockholm, and at MIPIM – the property exhibition in Cannes, France. The report contains responses from 170 investors in the Nordic market, and indicates a continued interest in commercial properties in the Nordic region over the next three to six months.

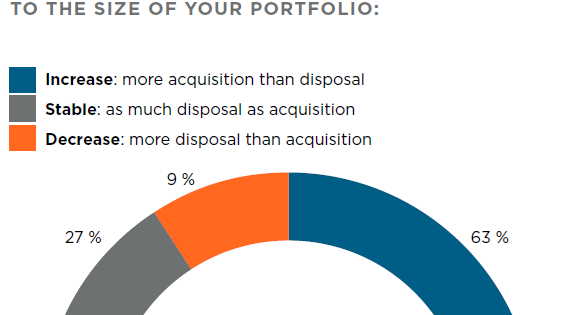

Of the investors, 63% say they are net buyers, 27% want to more or less maintain their current level of exposure, while only 9% say they are net sellers. Sweden accounts for somewhat fewer net buyers (49%) than the other countries. While the figures reflect continued strong buying pressure, the investors agree that the period of declining yields is over. On the other hand, most investors believe that yields have levelled out. However a growing minority with expectations of rising retail yields has also been reported in Finland, Norway and Sweden.

According to the investors, the growing demand for premises from tenants, particularly for offices, will drive value growth in the future. Demand for offices is expected to rise in Denmark, Norway and Finland, while three of four believe that the office rental market in Sweden will remain unchanged. None of the investors believe in a falling office rental market.

However, there is a major discrepancy in the view of retail premises throughout the region. In both Sweden and Norway, a rapidly rising share – 52% and 18%, respectively – expect to see weaker demand for retail premises. In Denmark, however, nearly no investors expect any declining demand for retail premises.

Industrial, or possibly primarily logistics, continues to attract investors. Of these, 60% expect the yields in Denmark and Finland to continue falling and, overall in the Nordic region, 66% of investors across the region believe in a growing interest from tenants in this segment.

In general, the report indicates a higher level of optimism among investors about their own portfolios than the broader market, which could lead to a gap in price expectations and, accordingly, to less market liquidity.

For Further Information Contact:

Agneta Jacobsson

Head of Sweden and the Nordics

+46 70 772 64 62

agneta.jacobsson@cushwake.com

or

Håvard Bjorå

Head of Research, Nordics

+47 47 96 96 60

havard.bjora@cushwake.com

Ämnen

About Cushman & Wakefield

Cushman & Wakefield is a leading global real estate services firm that helps clients transform the way people work, shop, and live. Our 45,000 employees in more than 70 countries help occupiers and investors optimize the value of their real estate by combining our global perspective and deep local knowledge with an impressive platform of real estate solutions. Cushman & Wakefield is among the largest commercial real estate services firms with revenue of $6 billion across core services of agency leasing, asset services, capital markets, facility services (C&W Services), global occupier services, investment & asset management (DTZ Investors), project & development services, tenant representation, and valuation & advisory. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.