Press release -

Full stop for Nordic real estate, lowest transaction volume in ten years

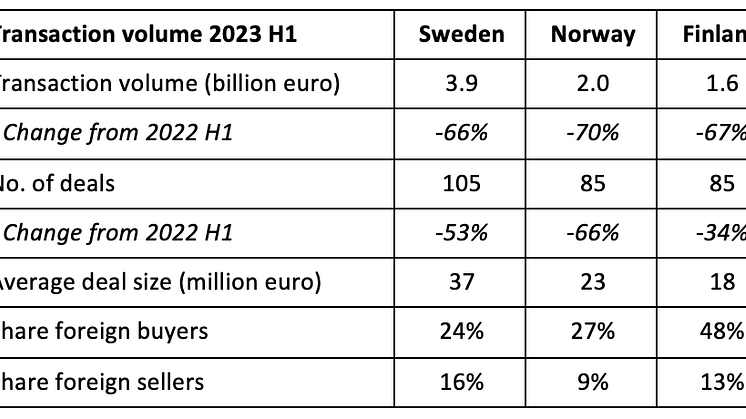

The transaction volume in the Nordic real estate market amounted to 9.6 billion euro during the first half of 2023, which corresponds to a decline of 68 percent compared to the same period last year. The volume is the lowest in ten years, and the trend is the same in all Nordic countries, according to new figures from Colliers Nordics as they summarize the first half of the year.

- We are seeing a dramatic slowdown in the transaction market, partly due to book values and price expectations adjusting very slowly to the higher interest rates. This makes directly owned properties expensive, in relative terms, and instead many investors turn their attention to discounted listed real estate, real estate funds, or real estate debt. There is a strong interest in commercial properties, but the capital is finding new paths, says Mikael Söderlundh, Head of Research & Partner at Colliers Nordics.

Source: Colliers Research, based on real estate transactions over five million euro

Listed real estate companies becoming major net sellers

In recent years, the listed property companies have gone from being the largest net buyers to the largest net sellers in the market. In 2021, the listed property companies accounted for 49 percent of all acquisitions in Sweden, but as of the first half of 2023, their share has decreased to ten percent. In the absence of listed companies, many real estate funds, foreign investors, and strong private players have stepped forward.

- There is almost an unlimited amount of capital avaliable. Just the Nordic real estate funds have up to eight billion euros in uninvested equity and double that in acquisition capacity. However, they still consider it too expensive and believe that prices need to be adjusted downward, says Bård Bjølgerud, CEO Nordics & Partner.

Logistics becomes the largest segment for the first time

During the first half of the year, logistics was the largest segment, accounting for 28 percent of the Nordic transaction volume, followed by residential properties at 25 percent and offices at 17 percent. It is the first time ever that logistics is the largest segment, and this goes hand in hand with a high share of foreign investors. Since the segment is very international, the price adjustment has been faster.

The five largest real estate transactions in the Nordics during H1 2023:

- AP7 acquires 33 percent of Urban Escape in central Stockholm from AMF Fastigheter

(SEK ~7.4 billion) - Altura acquires a portfolio of nursing homes in Sweden from Vectura

(SEK ~5.0 billion) - Northern Horizon acquires a portfolio of elderly care homes in Denmark from NREP

(not publicly disclosed) - Axfast acquires the city property Skotten 6 in Stockholm from Atrium Ljungberg

(SEK ~1.9 billion) - Heitman acquires the student housing company Bo Coliving in Norway from Rasting Eiendom among others

(NOK 1.8 billion)

- In the autumn, we expect a continued turbulent market with companies struggling, but activity will increase as buyers and sellers find each other. There are also conditions for further consolidation and structural deals in the market," Bård Bjølgerud concludes.

About Colliers Nordics

Colliers is a leading global real estate advisory firm with an enterprising culture. Our pan Nordic team consists of more than 250 professionals in Sweden, Norway, Denmark and Finland within the advisory business, whereas +80 Capital Markets experts. Colliers is the market leader in the region, with over 27% of market activity based on a full-year 2021 RCA data. Colliers experts offer qualified knowledge within Capital Markets, Debt Advisory, Project Finance, Leasing, Occupier Services, Valuation, and Research. With offices in all Nordic countries and a strong Nordic cooperation, we create effective solutions to create value for all our clients, both locally and cross borders.

For the latest news from Colliers visit our Nordic websites colliers.se, colliers.no, colliers.fi and colliers.dk or follow us on LinkedIn.

--------------------------------------------------------------------------------------------------------------------------------------

About Colliers Group

Colliers is a leading diversified professional services and investment management company. With operations in 66 countries, our 18,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 28 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of approximately 20% for shareholders. With annual revenues of $4.5 billion and $98 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.