Press release -

Roland Berger Automotive Outlook 2040: China's auto industry is on the rise, but Europe can succeed in turning things around

- The automotive markets of China, North America, Europe and the Global South are drifting apart, calling for new approaches across the global auto industry

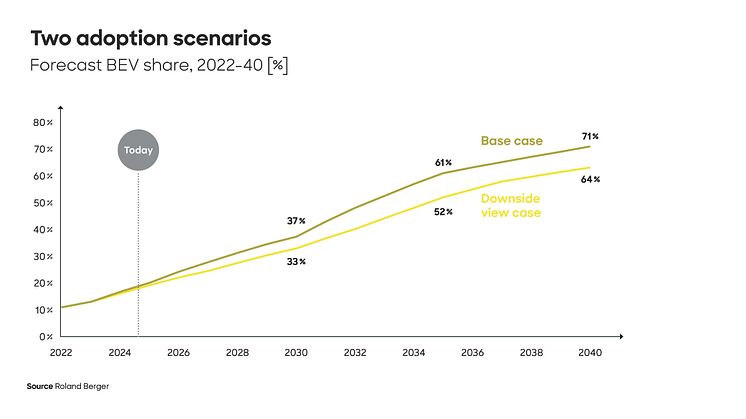

- Seventy percent of new cars sold globally will be battery electric vehicles by 2040; despite current challenges, Europe could exceed a 90 percent share sooner with the current legislature

- Chinese automakers will have captured 25 to 34 percent of the global market by 2040; six of the top 20 suppliers will come from China

- Europe’s auto industry can safeguard its future through consistent measures like hardware standardization, use of software platforms and closer cooperation

Munich, November 2024: The global automotive industry is in the midst of a period of disruption that will radically transform the sector over the next decade and a half. This is one of the findings of the new “Automotive Outlook 2040” by Roland Berger. The key factor is a regional shift in markets: While sales volumes will increase dramatically in the Global South and China to constitute some 60 percent of the global market in 2040, Western markets have already reached "peak auto" in terms of new vehicle sales. Yet, besides China, the Western markets are still a crucial pillar of the industry. Global new vehicle sales will grow by approx. 1.1 percent per year in the period to 2040. Electrification will continue simultaneously: Around 70 percent of new cars sold globally will be battery electric vehicles (BEVs) by 2040. Automation and growing vehicle connectivity will reshape the industry as well, with software overtaking hardware in importance. This will also alter the value chains and revenue pools of established car manufacturers and suppliers. However, with the right strategic priorities, opportunities for reasonable growth remain good.

"The global transformation that the automotive industry is going through is unstoppable and is only going to accelerate in the coming years," says Felix Mogge, Partner at Roland Berger. "The pace of change will be too fast for many companies. But the picture is not all bleak, because the disruption brings a great many new opportunities from which players that adopt smart strategies can profit." To work out the drivers behind the changes and develop scenarios for the future, Roland Berger conducted an in-depth study of the industry and its markets to create an overall picture in the form of the Automotive Outlook 2040. Four megatrends will shape the transformation of the industry through 2040: The future will polarized, automated, connected and electrified.

Peak auto in the West, continued growth in the rest of the world

Polarization is particularly evident in new vehicle sales: The Western markets of Europe, the USA and Canada have reached and, in some cases, passed peak auto in terms of new vehicle sales. Accordingly, these markets will likely stagnate or shrink slightly. But given their size, they still offer significant absolute growth, which the Roland Berger experts estimate at EUR 520 billion in the period to 2040. There will be a strong increase in new vehicle registrations in China (+1.2% p.a.), India (+4.2% p.a.), Latin America (+2.4% p.a.) and other countries across the Global South. In absolute figures, revenue growth in the period to 2040 will be strongest in China at around EUR 590 billion. Markets in the Global South are expected to grow in terms of absolute revenue by around EUR 480 billion; however, despite their strong growth rates, their share of the total market will only rise from 14 percent today to 20 percent in 2040. Overall, between 2025 and 2040, global sales volumes will grow 1.1 percent p.a. on average (having experienced 2.4 percent p.a. growth in the period 2010-2019).

One factor that is now expected to have only a minor impact on global vehicle sales, contrary to previous forecasts, is shared mobility. The Roland Berger experts see some growth ahead in the use of shared mobility solutions, but any increase will not be as rapid as previously anticipated and will be limited to large urban areas. Since only ten percent of travel takes place in these areas and this type of mobility complements trips in private vehicles rather than replacing them, shared mobility will be of lesser importance for the automotive industry's future.

The trend towards electric vehicles, on the other hand, is irreversible, in spite of the current consumer reticence in some markets. The number of battery electric vehicles is growing fast globally, and the Roland Berger experts predict that they will make up a share of between 64 and 71 percent of new vehicles in 2040, depending on the scenario. Another 20 percent will be hybrids, whereas hydrogen and e-fuels will play only a very minor role owing to their low efficiency and high costs. Electrification is ramping up at different speeds in different regions: Europe is expected to be fully electrified in a good ten years, assuming the EU sticks to its current regulations, with BEVs making up 99 percent of new vehicle registrations. In China, BEVs passed the 50 percent mark in July 2024 and will reach a share of between 70 and 85 percent by 2040, while the USA will see 42 to 60 percent and the rest of the world 50 percent.

Changes across the entire value chain

"Electrification is changing the balance of power in the industry – and not just because everyone is becoming more dependent on China for raw materials," says Jan-Philipp Hasenberg, Partner at Roland Berger. "There are structural shifts between the component categories, along the supply chains and in the target markets. The decline in components for internal combustion engines (ICEs) is more than offset by the increase in EV powertrains and batteries. Plus there are the E/E systems and components for ADAS and automation solutions." In total, global supplier revenue is set to grow 3.4 percent per year through 2040.

Growing connectivity means that by 2040 almost all new vehicles will be based on the concept of the software-defined vehicle (SDV), where the vehicle is built around the software platform and not the other way around. "All of that changes the demand for components, creates new business models and reinforces the shifts happening in the industry," says Mogge. "We expect the number of European suppliers in the global top 20 to fall from seven today to five in 2040, while the number of Chinese suppliers will rise from two to six; and the world's biggest supplier will then be found not in Europe but in China."

China is gaining ground, but Western OEMs can hold their own

The Automotive Outlook 2040 describes the tectonic changes – shifting mainly towards Chinese players – that are putting established companies, especially those in the West, under pressure. There is still a lack of visibility over what the situation will actually look like in 2040. The study authors came up with two possible scenarios: In the first, Chinese OEMs will have grown fast in all markets globally, accounting for more than half of the growth anticipated by 2040 and reaching a 70 to 75 percent market share in China, 15 to 20 percent in Europe and five to ten percent in North America. At the same time, Western OEMs will have suffered from stagnating or declining sales volumes, growing cost pressure and a major need for restructuring.

"In this pessimistic scenario from a Western view, the industry may reach a tipping point by 2040 in which Chinese OEMs have won the race," says Hasenberg. However, he does see possibilities for the second, more positive scenario to be realized: In it, Western car manufacturers will have captured 36 percent of the growth pool by 2040, while Chinese OEMs will retain a 65 percent share of their domestic market but only five to ten percent in Europe and less than five percent in North America. "Western OEMs are still investing heavily in technology, they have a good brand image and their production and distribution networks are strong," says Mogge. "But they do need to be much more efficient. If Western OEMs also radically change their approach, for example by making greater use of standardized hardware and software platforms from third parties, they may be able to become cost competitive again. This would result in a new balance of power globally by 2040, one in which all players have the opportunity for growth."

Topics

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger revenues stood at more than 1 billion euros in 2023.