Blog post -

Intercompany Netting – a simple concept with a great track record

I was recently invited by Anne-Marie Rice, Market Strategist at Analyste, a leading provider of cash management cloud solutions, to participate in a short webinar (20 minutes) to discuss the benefits of intercompany netting. Here’s some of the interesting discussion points and actionable outcomes for Treasurers and Financial Directors considering centralising financial relations between subsidiaries.

Watch the webinar - Intercompany Netting

What is Intercompany Netting?

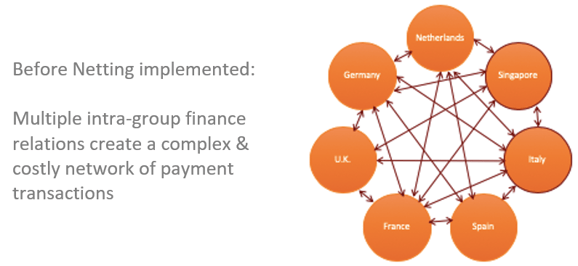

Large, multi-national or multi-franchise, organisations have a number of operational subsidiaries who regularly do business with each other, leading to a complex, intra-group web of payments and billing transactions, all of which require recording. Subsidiaries operating across a range of local currencies add to this complexity, not to mention hiked up transaction & FX rate costs across a plethora of bank accounts.

In short, intercompany netting was developed to centralise and co-ordinate intra-group financial relations, streamline processes, minimise resource demand, reduce banking costs and maximise working capital opportunities.

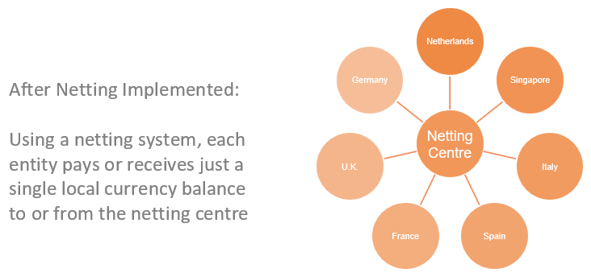

An arrangement between individual subsidiaries of a large corporate group, each subsidiary makes payments to or receives payment from a clearing centre (often called the Netting Centre), for net obligations due from other subsidiaries in the group. Netting is also used to reduce credit/settlement risk.

Why consider centralised Netting?

Corporates typically process hundreds, or even thousands, of vendor payments monthly. These payments are normally made, by each individual de-centralised subsidiary, using external banks which attract local or international bank payment fees - an expensive practice. In addition to the latter, local bank FX rates are an extra consideration when processing international vendor payments.

Creating a Netting Centre is often the first step for a company moving from a decentralised to centralised structure. It’s important to recognise that netting can also be effective for small companies, even if payments only exist between two subsidiaries, aka, bi-lateral netting.

Intercompany Netting - Main Benefits

Intercompany netting is increasingly popular with multi-subsidiary companies and large corporations – cost savings and improved efficiency are key justifications. Here’s some more detail around some of the immediate and measurable benefits.

- Reduced bank transaction costs: a measurable saving which can be tracked by simply calculating the number of pre-netting payments versus post-netting payments. Cost savings can thus be measured easily by multiplying the net number of payments x bank transaction costs. Example: I worked with a large engineering company some years ago who was able to accurately report that intercompany settlement transactions, across the group, were reduced by over 90% using a netting system

- Reduce the number of bank accounts and float: Netting often enables a reduction in the number of banks (and their associated costs) employed by a company, thus also reducing float

- Reduce FX costs: fewer, high value, payments at better currency rates

- Improved intra-group payments efficiency: reducing the number of mismatched payments

Why do companies use Intercompany Netting and what problems does it solve?

Netting is one of those concepts whose outcome can be measured and therefore justified. It is easy to show the savings that a good netting system can deliver. However, the reason large organisations and corporates use netting goes beyond measurable savings.

In a company where there is no corporate hedging in situ, international payments rates can be typically quite poor. Netting centralises this practice and offers organisations the opportunity to negotiate better rates with their banks.

As mentioned earlier, netting reduces the volumes of payments that need to be processed because intercompany flows are netted at one time period and subsequently, the cost of external payments falls quite dramatically. In addition, cash kept locally, in a decentralised structure, will often attract lower rates and therefore be invested less optimally than approached on a group basis. Centralised netting facilitates better rate negotiation.

Netting also brings much improved control around the inter-company payments process and therefore, the issue around the volume of payments and time they are processed is centralised and better managed with increased transparency. In addition, netting systems can be used to settle other types of intra-group transactions including intra-group loans, interest, etc.

Netting can also be used for external payments between trading partners or groups of trading partners.

All in all, netting provides so many benefits to companies it is no surprise it is such a popular concept.

Watch the webinar - Intercompany Netting

Author: David Kelin (Managing Director at DNA Treasury Limited)

Contact: david@dnatreasury.org

For more information on the key features and benefits of the Analyste Netting cloud solution,

Topics

- Computers, computer technology, software