Press release -

2011-12 tax gap figures published

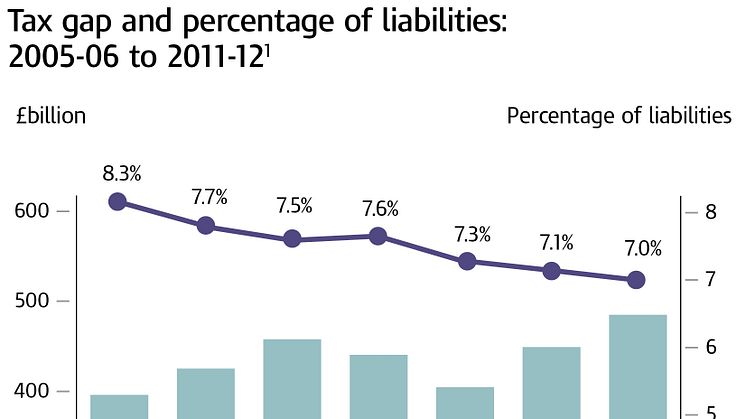

Figures released by HM Revenue and Customs (HMRC) today estimate the tax gap for 2011-12 at 7 per cent (£35 billion) of tax due, continuing a long-term downward trend.

The tax gap has fallen steadily over the last six years, from 8.3 per cent of tax due in 2005-06 to 7.1 per cent in 2010-11 and 7 per cent in 2011-12. The tax gap is regularly revised to take account of improved methods and the latest available information, and the figures published today include revisions going back to 2005-06. Alongside existing estimates of the beer and spirits tax gaps, a new estimate for the wine tax gap has been included for the first time.

The tax gap is compiled from around 30 separate estimates for different taxes and is broken down by type of tax, customer group and customer behaviours, including tax evasion and avoidance, customer error, the hidden economy, criminal attacks and where tax cannot be collected because businesses have become insolvent.

Exchequer Secretary David Gauke said:

“These figures show the tax gap is continuing to fall. The vast majority of businesses and individuals pay the taxes they owe. But where they don’t it is for HMRC to challenge non-compliance fiercely, protecting money that would otherwise be lost.

“Since 2010, the Government has invested nearly £1 billion in additional compliance initiatives over the Spending Review period. HMRC is on track to secure a further £44 billion in tax revenues over the next two years.”

Edward Troup, HMRC’s Tax Assurance Commissioner and Second Permanent Secretary, said:

“The range of non-compliance behaviours revealed by these tax gap figures underline why it is so important for HMRC to step up our wide-ranging activities against the minority who aren’t paying what’s due, whether they are SMEs, individuals, big business or organised criminals. This isn’t just critical for the nation’s finances: it’s also important to protect the vast majority of honest businesses and individuals from being cheated by the unscrupulous few.”

Notes to editors:

1. The percentage tax gap has fallen very slightly from 7.1 per cent in 2010-11 to 7 per cent in 2011-12. However, the value of the tax gap has increased from £34 billion in 2010-11 to £35 billion in 2011-12, mainly due to an increase in the VAT gap reflecting the rise in the standard rate of VAT to 20 per cent.

2. The UK is one of the few countries to publish its estimate of the tax gap; our transparency on this is a sign of our determination to tackle non-compliance. Caution must be exercised when comparing internationally, as methodologies, the periods that estimates relate to and tax systems differ. On the basis of the figures below, the UK is unquestionably at the low end of the range.

|

Country |

Tax gap as a percentage of total tax liability |

Year(s) the estimate relates to |

|

Mexico |

23% |

2008 |

|

USA |

14.5% |

2006 |

|

Sweden |

10% |

2001-2005 |

|

UK |

7.0% |

2011-12 |

3. See the tax gap statistics here: https://www.gov.uk/government/organisations/hm-revenue-customs/series/measuring-tax-gaps

4. A PDF version of the new publication is available:

http://www.hmrc.gov.uk/statistics/tax-gaps/mtg-2013.pdf

5. Follow HMRC on Twitter @HMRCgovuk

6. Images are available on HMRC’s flickr site www.flickr.com/hmrcgovuk

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.