Press release -

ALLIANZ ACHIEVES GOOD GROWTH AND MAINTAINS SUB 100% COMBINED OPERATING RATIO DESPITE THE WEATHER

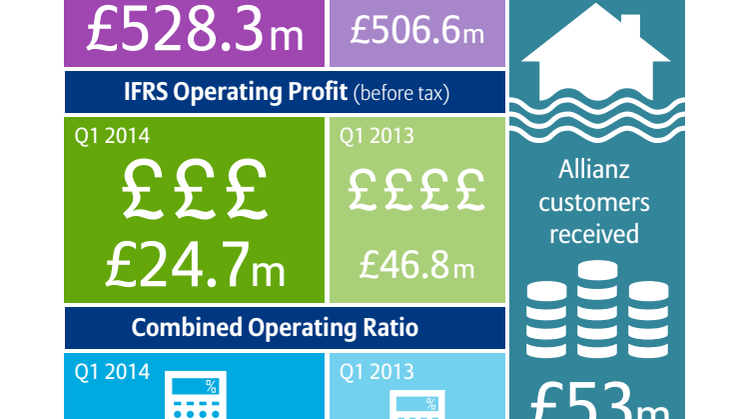

Group Results Q1 2014 Q1 2013

• Gross Written Premium £528.3m £506.6m

• IFRS Operating Profit (before tax) £24.7m £46.8m

• Combined Ratio 99.8% 95.2%

Divisional Results Breakdown Q1 2014 Q1 2013

Commercial:

• Gross Written Premium £275.7m £259.3m

• Combined Ratio 98.7% 95.1%

Retail:

• Gross Written Premium £252.5m £247.3m

• Combined Ratio 102.5% 95.4%

Statement from Chief Executive Officer, Jon Dye

I am pleased with the top line growth performance of the organisation during the quarter with GWP up 4.3% compared to the same period in 2013. We have also added around a quarter of a million new customers to our book which is in line with our longer term ambition to grow our business markedly from where it is today.

As expected, the cost of the UK’s wettest winter on record has had a negative influence on our profit performance compared to Q1 2013, which was a benign quarter for weather and large claims. However, it is satisfying that despite the cost of the weather, we maintained our Combined Operating Ratio at below 100% which shows the strength of the underlying performance of our business.

Commercial Division

GWP for our Commercial business has grown by 6.3% through a combination of rate increase and improved new business activity. The prevailing market conditions which became more difficult in the last quarter of 2013 have remained, and so in Q1 we continued to focus our new business and retention activities in our stated areas of core appetite. Following such an adverse period of bad weather, achieving a Commercial COR of 98.7% is an excellent achievement.

Commercial Motor continues to be a strong driver of growth at good levels of underwriting profit as does our Motor Trade account.

After two years of underwriting action, the Liability account grew by 4.4% compared with Q1 2013, with profitability improving in this challenging area.

Our Packages account revenue has grown strongly above the Q1 2013 level as the market-leading platform QuotesSME gains further traction and attracts very positive feedback from brokers.

The Engineering business GWP has grown above plan as we seek to reach more brokers with our revised construction proposition.

Retail Division

Retail GWP has grown by 2.1% compared to the same period in 2013, which is a good performance.

The level of growth has been held back because of the hugely competitive private car market. The deterioration in the Retail COR is directly attributable to the impact of weather claims.

Our Direct business has grown markedly from its position in Q1 2013 and since the last quarter of 2014, but the rapid softening of the private car market has had the effect of moderating our rate of growth because we will not price our products to achieve market share alone.

Petplan delivered another quarter of strong growth, up 7.3% on last year and the business also delivered a good profit performance. With record customer numbers on the books this business continues to deliver positive results across all the key customer satisfaction measures.

The Corporate Partner business GWP is up significantly over prior year which reflects the commencement of the pet insurance partnership with Sainsbury’s as well as the continuing relationships we have in the automotive and mobile phone sectors.

In Broker, the motor market remains highly competitive and we have adjusted our appetite for growing this account accordingly. In contrast, the household account continued to grow at a satisfying rate compared to Q1 2013.

The Legal Protection business performed well in Q1 and profitability remains good. We have begun trading with some strong propositions in the post LASPO environment but it will be some time before we are in a position to judge their success.

Other News

I am proud that the Chartered Insurance Institute awarded Allianz Retail with the status of Chartered Insurer in recognition of our commitment to excellence and professionalism. Allianz Retail is one of the first personal lines insurers to be granted this status.

Allianz Commercial achieved Chartered status in 2010 and Home & Legacy were awarded Chartered Broker status in 2012. This latest achievement keeps us at the forefront of professionalism within our industry.

Conclusion

The adverse weather during the quarter dominated the news headlines and it represents the key to understanding the performance of Property and Casualty insurance in the UK during Q1. We estimate the cost to our business to be £20m over and above our normal attritional weather for the quarter. The total cost to the business going back to the St Jude storm and including the North Sea surge and the subsequent extreme weather in December, January and February is £53m. This is a considerable sum but we believe we are indexing below our fair market share of the overall loss to the industry.

As the first quarter numbers reveal, we are growing our business well in those areas where we can see the opportunity of achieving a reasonable level of profit. Furthermore, without the weather losses, the profitability of the business would also have been where we would have expected it to be at this stage of the year. The performance of the business during this very challenging time reinforces our belief that our long term goal to significantly grow this business profitably over the next five years is very achievable.

Jon Dye,

Chief Executive

Ends.

Notes for Editors:

1. Allianz Insurance is one of the largest general insurers in the UK and part of the Allianz SE Group, the largest property and casualty insurer worldwide. Around 83 million private and corporate customers rely on Allianz's knowledge, global reach, capital strength and solidity to help them make the most of financial opportunities and to avoid and safeguard themselves against risks. In 2013, around 148,000 employees in over 70 countries achieved total revenue of 110.8 billion euros.

2. Media Contact: Mark Bishop, Group Communications Manager

Telephone Numbers:

Work - 01483 552731

Mobile - 07802 925053

Email – mark.bishop@allianz.co.uk

Topics

Regions

Allianz Insurance is one of the largest general insurers in the UK and part of the Allianz SE Group, the largest property and casualty insurer worldwide.